ЖИЗНЬ БИТКОИНА В ЗАГАДКЕ: НАСТОЯЩИЙ ЛИ ОН НЕЗАВИСИМЫЙ?

Итак, вы знаете, как иногда вы говорите: «О, я свободный дух, мне все равно, что думает кто -то еще!» 🙋♀ Но тогда вы понимаете, нет, вы на самом деле раб на рынке и свои эмоции? 😂 Это что -то вроде того, что сейчас происходит с биткойнами.

💸 Если твой портфель скучает, ФинБолт подскажет, когда его оживить – купи, продай и зажги рынок!

Присоединиться в TelegramSince February, when Donald Trump

Donald Trump

Donald Trump is an American former president politician, businessman, and media personality, who served as the 45th president of the U.S. between 2017 to 2021. Trump earned a Bachelor of science in economics from the University of Pennsylvania in 1968. Trump won the 2016 presidential election as the Republican Party nominee against Democratic Party nominee Hillary Clinton while losing the popular vote. As president, Trump ordered a travel ban on citizens from several Muslim-majority countries, diverted military funding toward building a wall on the U.S.–Mexico border, and implemented a family separation policy. Trump has remained a prominent figure in the Republican Party and is considered a likely candidate for the 2024 presidential election

President

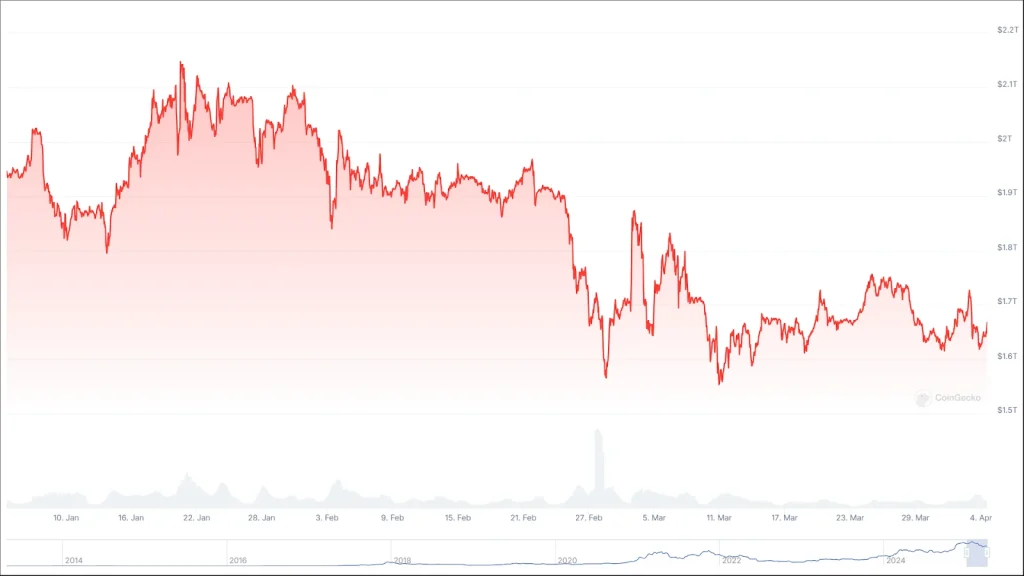

officially announced his aggressive tariff plan, the US economy has been in a turbulent state. At the start of that month, the S&P market was at $5,969.58. Since then, the market has declined by at least 9.5%. Similarly, the Nasdaq 100 index has dropped by over 12.14%. Surprisingly, Bitcoin, which is generally considered as a hedge against market uncertainty, has followed the trend in the US stock market during the period, as it has decreased by approximately 18.49%. Meanwhile, during the period, gold has surged by no fewer than 10.47%.

Теперь, вы могли бы подумать, что Биткойн будет похож на: «Эй, я цифровое золото, я безопасный убежище, я не коррелированный актив!» 💃 Но нет, он действовал как актива риска, продавая вместе с акциями. Как будто это говорит: «О, я свободный дух, мне не волнует рынок!» 🙃 Но на самом деле это просто раб на рынке, как и все мы.

Enter Michael Saylor

michael saylor

Michael Saylor is a Co-founder of Strategy formerly MicroStrategy. Before founding Microstrategy, he was a rocket scientist and studied aeronautics and astronautics at MIT on an Air Force scholarship. He dubs Bitcoin ‘Digital Gold’. He made some early investment in Bitcoin as soon as he realized it was going to be the next big thing in shaping decentralized finance from traditional finance. His firm Strategy has made Bitcoin their primary treasure reserve. He is a vocal advocate and Top Bitcoin Speaker who participates in various Bitcoin and Crypto events. Michael Saylor is highly skilled in and has a rich knowledge of numerous fields, including analytics, data warehouses, SaaS, management, cloud computing, enterprise architecture, mobile devices, and many more.

Personal Details:

Born: Feb 4, 1965Location: United StatesGraduation: He graduated from MIT in 1987 with a double major in aeronautics, science, technology, and society.

Michael Saylor – Career Timeline

1983–1987: Studied Aeronautics & Astronautics and Science, Technology & Society at Massachusetts Institute of Technology (MIT).

1989: Co-founded MicroStrategy (Strategy).

1998: MicroStrategy IPO – Took MicroStrategy public on the NASDAQ at $12 per share.

2000: Accounting Scandal & Crash – MicroStrategy’s stock plunged 62% in a day due to an accounting misstatement, wiping out billions in valuation.

2004–2019: MicroStrategy Rebuilds – Worked towards cloud-based analytics and AI-driven business intelligence, regaining stability.

2020: Bitcoin Strategy & Investment – Led MicroStrategy’s $425M Bitcoin investment. He made it the first publicly traded company to adopt Bitcoin.

2021: Bitcoin Evangelism – Became one of Bitcoin’s most vocal advocates, encouraging corporations and institutions to adopt BTC and blockchain.

2022: Stepped Down as CEO – Transitioned to Executive Chairman to focus entirely on Bitcoin strategy.

msaylor@microstrategy.com

EntrepreneurCrypto and Blockchain ExpertAuthor

![]()

who’s like, «Hey, calm down, folks! This is just a short-term thing!» 🙏 He says that Bitcoin’s high liquidity and 24/7 availability make it a convenient asset to sell during market downturns. It’s like, «Oh, I’m a risk asset, but only short-term, I swear!» 🤑

Но «🤣

Фактически, в 2024 году цена Биткойна выросла на 121,1%, в то время как индекс S & P 500 вырос только на 24,05%, а NASDAQ 100 на 27,10%. Золото, с другой стороны, увидел рост всего 27,54%. Итак, может быть, биткойн более независим, чем мы думаем? 🤔

Часто задаваемые вопросы

Как тарифы в США повлияли на цену Биткойна?

Биткойн упал на 18,49% с момента объявления тарифа, отражая неприятие риска в общем рынке, но эксперты считают это временной тенденцией.

Будет ли биткойн восстановиться после недавнего падения?

Если рыночная неопределенность облегчит, Биткойн может отскочить, а аналитики рассматривают 2400 долларов в качестве следующего уровня сопротивления.

Никогда не пропустите ритм в крипто -мире!

Оставайтесь с новостями, экспертным анализом и обновлениями в реальном времени о последних тенденциях в биткойнах, альткойнах, DEFI, NFTS и многое другое.

Смотрите также

- Курс евро к злотому прогноз

- Курс юаня прогноз

- Прогноз нефти

- Анализ Aethir: тенденции рынка криптовалют ATH

- Анализ Dogecoin: тенденции рынка криптовалют DOGE

- Курс доллара прогноз

- Анализ NEAR Protocol: тенденции рынка криптовалют NEAR

- Анализ Saros: тенденции рынка криптовалют SAROS

- Анализ Cardano: тенденции рынка криптовалют ADA

- Анализ Celestia: тенденции рынка криптовалют TIA

2025-04-04 13:07